Table of Content

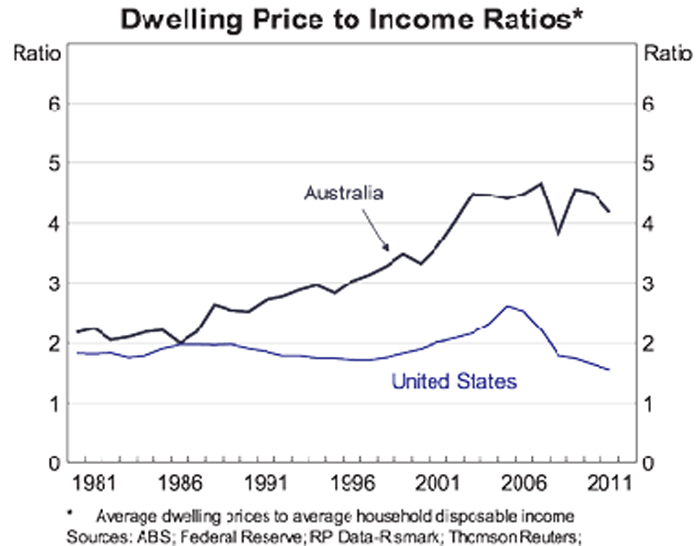

However, at the same time, if you block that, then you won’t have enough people to pay market rent. From 2019 to 2021, the average house-price-to-income ratio increased from 4.7 to 5.4 — a 14.9% increase that's more than double the recommended ratio of 2.6. In other words, homes cost 5.4x what the average person earns in one year. By contrast, average home prices in the 10 metros with the lowest house-price-to-income ratio are 2.5x higher than income, up just 10% from the average of 2.3 in 2000. From 2017 to 2021, home values rose an average of 17.8% — while income increased by just an average 6.2%.

Of note, the CSDs of West Vancouver (17.2) and Richmond (12.2) had the highest median PIRs of all CSDs observed. Additionally, the income measure excludes capital gains and includes only the income reported the year the property was purchased, leaving out all unreported income. The PIR presented in this article is a new measure for the Canadian context that builds on the STIR and the housing hardship measure, as it can be used to monitor housing affordability at the time of purchase. By linking the price of the property sold to the income of its buyer, the PIR provides an indication of the financial burden faced by home buyers when purchasing residential real estate.

A snapshot of residential property owners

The country’s index is 94.2 in Q2 2021, up 17.6% over the past five years. You may have noticed that this number is less than 100, meaning it’s more affordable than in 2005. As a result, the comparisons between home prices and income are not perfect and are for illustrative purposes only.

Here’s what they had to say about the country’s largest markets. The four main property types comprise single-detached houses, semi-detached houses, row houses, and condominium apartments. These include owners who did not recently purchase property and new home buyers who did not claim the tax credit.

Canada House Price To Income Change

Looking for specific market information to create new editorial content or innovative ways to present and share housing trends and statistics? Gain unparalleled insight into the dynamics of a highly varied Canadian housing market with the Teranet-National Bank House Price Index™ monthly public release. Usually you have decent comments, but not sure about your comment today. I’d bet over 65+ percent of people who read your articles would locate either or both countries. Now, if Toronto becomes solely a foreign capital/money laundering pad, then you’re right, prices will just keep going.

… to incorporate the statistic into your presentation at any time. "House-price-to-income Ratio in Selected Countries Worldwide as of 2nd Quarter 2022, by Country."

Other statistics on the topicCanadian housing market

In West Vancouver this is due to the highest median assessment values ($2.7 million), while in Metro Vancouver A the median income of property owners ($68,800) was the lowest in the CMA. The analysis on owner income provides insights on first-time home buyers who claimed the home buyers’ amount in 2017. It also offers details on these owners and the propertiesNote they purchased between January 1st and December 31st, 2017. More than three-quarters of owners in British Columbia, Ontario, and Nova Scotia were married or in a common-law relationship compared to around one-third of those who did not own property in these provinces. The median property assessment value-to-income ratio was highest in the Vancouver census metropolitan area where property values were nine times greater than the income of owners.

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings. Jason Heath is a fee-only Certified Financial Planner and income tax professional for Objective Financial Partners Inc. in Toronto, Ontario. This means a first-time homebuyer needed a downpayment that was five times larger and paid three times as much interest on every dollar borrowed.

This table displays the results of Data table for Chart 4 Condominium apartment and Single-detached house, calculated using percent units of measure . Just over half of HBA claimants were married or in a common-law relationship compared to three-quarters of owners who did not claim the amount. Although overall ownership rates tended to be evenly split between males and females, the share of males among HBA claimants was higher at 58.7%.

Co-ownership patterns of claimants also varied by property type where more than half who bought a condominium apartment were the sole owners. Residential properties owned by the bottom 20% income earners had the highest property value-to-income ratio of 32.3 in the Vancouver CMA. I bought a crap townhouse in Sarnia Ontario south end, where I couldn’t sleep half the time because of flare stacks and shunting trains smashing together at 3AM. We are in a weird spot that there are jobs everywhere in towns and cities throughout Canada, many being quite affordable.

As disastrous as that sounds, the firm isn’t expecting a big housing crash the baseline model shows low to no price growth, as mortgage rates rise. This table displays the results of Before-tax income ranges of residential properties by quintile. The information is grouped by Income quintile , Vancouver CMA, Toronto CMA and Halifax CMA, calculated using before-tax income range units of measure . These high value-to-income ratios could be a result of property owners that may have acquired their properties in the past when assessment values were substantially lower, or may no longer be carrying a mortgage. Moreover, these owners may have earned pension income or accrued income outside of Canada, as the following findings show.

Census, including national household income data and median new residential sales values. All dollar values are adjusted for 2021 inflation, unless otherwise noted. This table displays the results of Median assessment value and before-tax income of residential properties and property owners in British Columbia. The information is grouped by Geographic region , Median assessment value, Median before-tax income and Median value-to-income ratio, calculated using dollars units of measure .

Today, it’s not uncommon to hear of people offering far more than the seller’s asking price — with some even offering $1 million more than the listing price. But during the peak of the Toronto housing bubble in 1989, mortgage payments as a percentage of median family income were about 50%. Going forward, interest rates aren’t likely to increase in the short term in Canada. But when interest rates rise, housing affordability will be squeezed because more of a family’s income will go towards mortgage payments and other interest costs. Saying Canadian home prices are frothy, is like saying Mozart had a little musical talent.

Home prices have increased an astounding 3.1x faster than income since 2008. We found that since 1965, average home values have skyrocketed from $171,942 to $374,900 — a 118% increase. Meanwhile, median household income crept up just 15%, from $59,920 to $69,178 in 2021-inflation-adjusted dollars. …The OECD house price-to-income ratio index…measuring an affordability fundamental, shows that Canada’s housing is severely overvalued… the second fastest growing gap between home prices and incomes in the developed world…. Non-resident owners in most cases do not report any Canadian income, and the data used for this article do not account for worldwide income earned by non-resident owners. This table displays the results of Median value-to-income ratios by income quintile.

Description of the infographic The title of this infographic is "How the price-to-income ratio is calculated".The infographic contains three labeled images that form an equation showing how the price-to-income ratio is calculated. The left side of the equation contains the first image titled price-to-income ratio. On the right side of the equation are two images showing that the sale price of the property is divided by the combined income of the buyers. Only properties sold in market sales and individual resident buyers are included in the analysis. As the third and final part of this series, this article examines the relationship between the purchase price of properties and the income of buyersNote by calculating the price-to-income ratio at the property level.

No comments:

Post a Comment