Table of Content

In Greater Vancouver, the average price of a home was close to 12 times the average local income in 2016, according to data from the Canadian Real Estate Association and Statistics Canada. Here’s a look at average incomes relative to average home prices across markets over the last 40 years. Incomes in Canada have steadily risen since 2000 and show no signs of slowing down in the near future. This should improve housing affordability, as long as home price growth slows down. The CMHC has shown that the housing hardship rate was approximately 9% in 2017, while approximately 11% of households had an STIR over 30% .

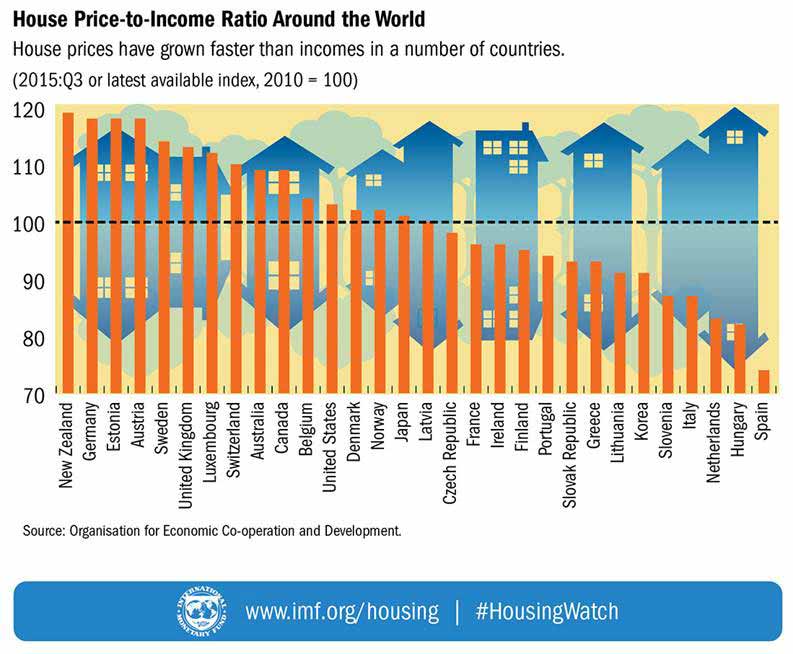

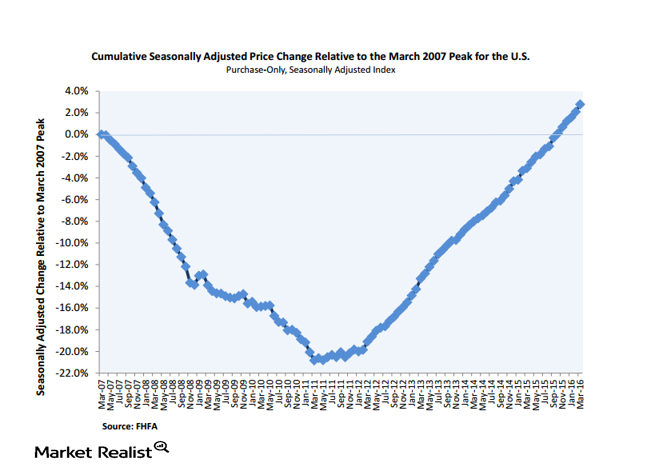

Between 2008 and 2021, average home values soared by 25%, from $298,910 to $374,900. Meanwhile, median household income has scarcely budged, with a modest 8% increase, from $63,902 to $69,178. Since the last major housing market crash in 2008, the average house-price-to-income ratio has grown steadily worse.

Germany Home Prices Are Growing Much Faster Than Incomes

Properties purchased by immigrants were closer to city centres where there is broader access to social services, community support and job opportunities. Indeed, price declines were observed in all markets covered, with the last cities on the list to experience contractions being Calgary, Edmonton, Lethbridge and Trois-Rivières. Since its peak in May 2022, the national composite index has already fallen by 9.0%, almost as much as during the last financial crisis (-9.2%). With the Bank of Canada raising its key interest rate again in December and mortgage rates remaining high, we believe that the impact on property prices should continue to be felt in the coming months.

Today, it’s not uncommon to hear of people offering far more than the seller’s asking price — with some even offering $1 million more than the listing price. But during the peak of the Toronto housing bubble in 1989, mortgage payments as a percentage of median family income were about 50%. Going forward, interest rates aren’t likely to increase in the short term in Canada. But when interest rates rise, housing affordability will be squeezed because more of a family’s income will go towards mortgage payments and other interest costs. Saying Canadian home prices are frothy, is like saying Mozart had a little musical talent.

Canada House Price To Income Change

This article furthers the OECD's approach by looking strictly at the income of property buyers, as opposed to including all persons in a region. Additionally, the PIR in this article uses the income data of the buyers of a property as opposed to national disposable income per capita. The lowest-income buyers purchased properties with the highest median price-to-income ratios, reaching 18 in British Columbia, compared with less than 4 in New Brunswick and Nova Scotia. Properties purchased in the largest cities had the highest price-to-income ratios. This was most pronounced in the Vancouver census metropolitan area, where the median price-to-income ratio was 7.4. This chart shows the ratio of the average UK house price to average annual income.

Table 1 shows that the assessment value-to-income ratio was highest in British Columbia, particularly in the Vancouver CMA where property values were nine times greater than the income of owners. This value-to-income ratio in the CMA was even more marked for single-detached houses, with assessment values 11.5 times higher than the income of owners. Germany’s residential real estate market is next, and it’s not even really that close. The country’s index hit 128.5 in Q2 2021, up 27.6% from five years before. Home prices have grown 28.5% faster than disposable income since 2005 — about half the rate Canada has seen.

Buyers in the lowest income quintile purchase properties worth 29 times their income in Vancouver

Since then, the ratio has gradually tapered to mostly flat movements. You shouldn’t need a crystal ball or magical powers to understand real estate. Since 2016, Real Estate Witch has demystified real estate through in-depth guides, honest company reviews, and data-driven research. In 2020, Real Estate Witch was acquired by Clever Real Estate, a free agent-matching service that has helped consumers save $70 million on realtor fees.

I think that when we, as a country, decide to ask how all this money is available , only then can we begin the process of making changes that reverse the pricing trend, and get them back down to median affordability. And even with rents only half as elevated as here , Germany recently nationalized rents in Berlin to reduce prices. The US, not known for its fiscal restraint, looks like a country of penny pinchers compared to the rest of the G7.

But these same homeowners could be poised for disaster in the next housing crash. This is especially troubling for people who bought homes during the pandemic because they’ve had the least amount of time to pay back their mortgage. Every quarter the Canada Mortgage and Housing Corporation , the Crown agency in charge of Canadian housing research, publish a report on how real estate fundamentals are looking. They then publish a color graded warning system for real estate.

Even in Alberta, where the housing market has been dormant for years, activity is heating up. This year, Calgary saw its best March in terms of sales volumes since 2007. The jump has been more pronounced in some of Canada’s smaller communities. In February, BMO economist Sal Guatieri noted that in Woodstock, Ont., the benchmark home price had risen “a cool” $118,200 over the previous 12 months, more than the $86,970 the median local family earned in 2018. Housing marketReal estate in ChinaCommercial property in the U.S. To use individual functions (e.g., mark statistics as favourites, set statistic alerts) please log in with your personal account.

But if the current breakneck appreciation continues, “then we’re going to get into a situation where it’s almost a necessity that house prices actually fall to restore order and balance in the housing market,” Guatieri says. National statistics show the average national home price is now more than seven times the average household income, according to data from the Canadian Real Estate Association and Statistics Canada. In the pandemic-linked housing boom, average residential property values have become decoupled from average incomes over vast swathes of the country. There were important differences between the ages of the buyers in the lowest income quintile. The median age of buyers, when at least one immigrant buyer was involved in the purchase of the property, was lower , compared with the non-immigrant group .

In particular, the majority of sales in the three provinces involved more than one buyer, highlighting possible challenges faced by single individuals in becoming homeowners. Additionally, the income gap between first-time home buyers and repeat buyers in British Columbia may point to the difficulties of entering the real estate market in areas where property prices are higher. Finally, immigrants purchased more expensive properties compared with non-immigrants.

No comments:

Post a Comment